Financial Rights Awareness Coalition (FRAC)

Empower Yourself

Make Informed Decisions

FRAC is dedicated to promoting financial literacy and consumer rights in Canada. Our mandate is to empower individuals with the knowledge to make informed financial decisions. We have successfully conducted numerous awareness campaigns and educational programs, reaching thousands of Canadians.

EasyFinanical Proceeding

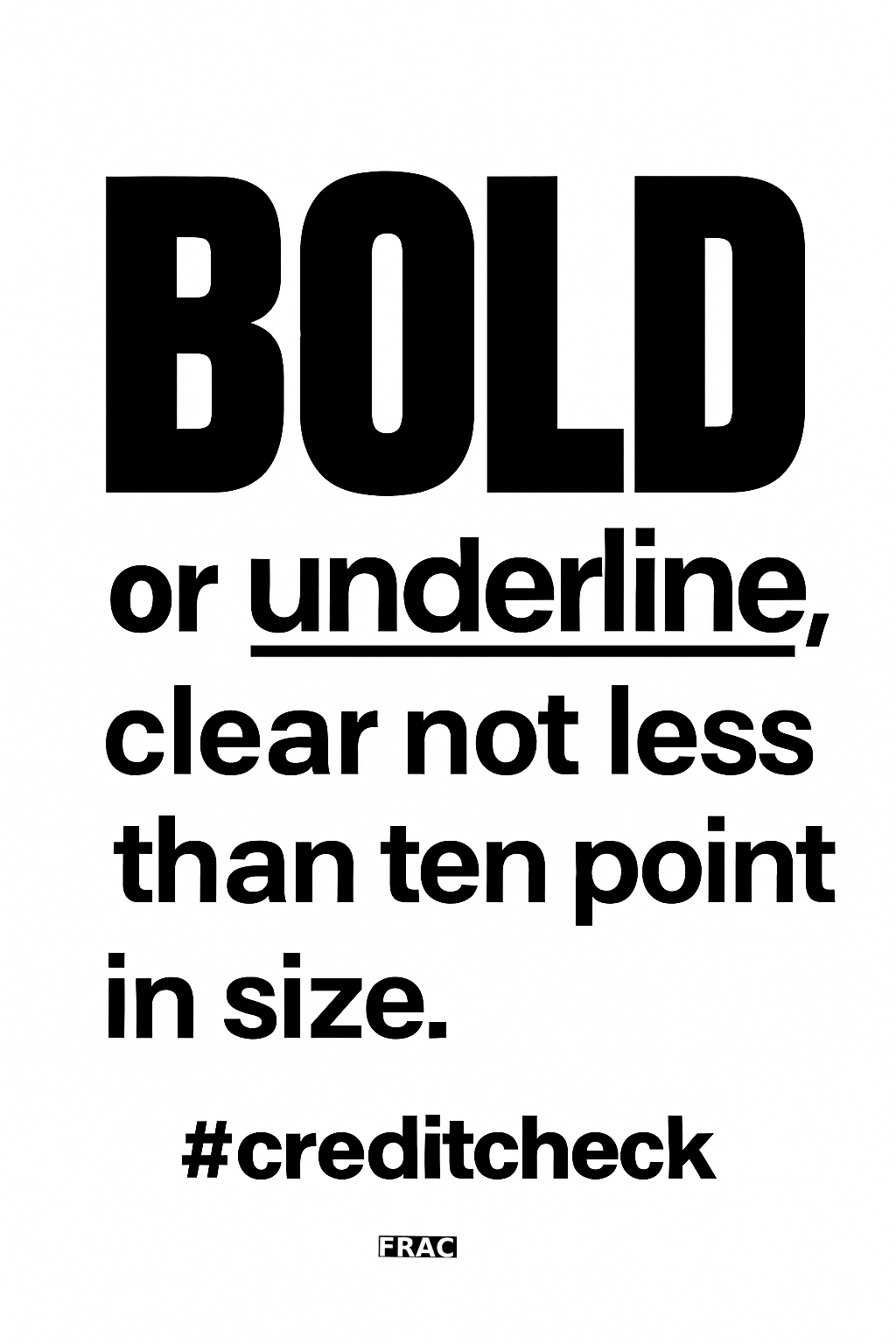

Credit Check: What You Must Know

A credit check must be BOLD or underlined, in a font size no less than 10 points.

R.I.S.K – Reform In Systems & Knowledge

Financial institutions are required to provide information about the nature, purpose, and consequences of the collection, use, and disclosure of personal information at the time of decision, enabling consumers to make informed choices, including reasonably foreseeable risks such as those caused by bad actors. These may include financial loss, reputational damage, humiliation, negative effects on credit records, and identity theft. This transparency ensures that consumers can make informed decisions and avoid deceptive practices.

This directive is supported by the Guidelines for Obtaining Meaningful Consent, which require organizations to clearly inform individuals of (a) the types of personal information being collected, (b) the parties with whom the personal information is shared, (c) the purposes for which the personal information is collected, used, or disclosed, and (d) the risks of harm and other potential consequences at the time of accessing services.

T.E.C.H – Transparency, Encryption, Consent, Honesty

Financial institutions have shifted to the digital era of e-commerce and are moving away from paper-based applications. However, unlike paper-based processes, financial institutions must now implement adequate technological safeguards to protect electronic consent, particularly when it is collected through checkboxes as a form of electronic signature.

Financial institutions must demonstrate that they have implemented technological safeguards, specifically secure electronic signature technology or digital signature certificates, ensuring that the electronic signature (a) is unique to the individual using it, (b) is under the sole control of the individual incorporating, attaching, or associating their electronic signature with an electronic document, (c) can be used to identify the individual, and (d) is linked to the document in a manner that allows detection of any modifications after its incorporation.

Financial institutions must also demonstrate compliance with the Secure Electronic Signature Regulations, including digitally signing documents with valid certificates, applying recognized cryptographic hash functions to generate and encrypt message digests using private keys, attaching or embedding encrypted digests into documents, transmitting documents together with verifiable certificates, and performing proper verification upon receipt, including certificate validation, as required under Sections 2 and 3 of the Regulations.

Financial institutions cannot without full compliance benefit from the presumptions under Section 5 of the Secure Electronic Signature Regulations; the only acceptable alternative is the use of a valid digital signature certificate.

Latest Insights

09/12/2025

Mogo Finance Technology Inc.

POLICY AMENDMENT

09/12/2025

Equifax Canada

POLICY AMENDMENT

09/12/2025

Home Trust

POLICY AMENDMENT

09/12/2025

Capital One Bank

POLICY AMENDMENT

09/12/2025

Mogo Finance Technology Inc.

POLICY AMENDMENT

09/12/2025

Metropolitan Credit Adjusters Ltd.

POLICY AMENDMENT

09/12/2025

Equifax Canada

POLICY AMENDMENT

09/12/2025

Capital One

POLICY AMENDMENT

09/12/2025

Capital One

POLICY AMENDMENT

09/12/2025

Capital One

POLICY AMENDMENT

09/12/2025

Capital One

POLICY AMENDMENT

09/12/2025

Neo Financial

POLICY AMENDMENT

09/12/2025

Home Trust

POLICY AMENDMENT

09/12/2025

Home Trust

POLICY AMENDMENT

09/12/2025

Home Trust

POLICY AMENDMENT

09/12/2025

TransUnion Canada

POLICY AMENDMENT

09/12/2025

TransUnion Canada

POLICY AMENDMENT

1. Acknowledging the receipt of an access request in writing within 30 days. The recommendations included adding explanatory wording within their written acknowledgment (e.g., clarifying identification requirements and that they engage directly with the consumer, not with credit repair companies). This ensures the requester is informed of any missing information needed to fulfill the access request.

2. Informing the requester/complainant of their right to file a complaint with the Office of the Privacy Commissioner of Canada once an access request has been fulfilled or a complaint/dispute investigation is completed. This helps the requester/complainant understand that this is the organization’s final response to the request or complaint/dispute.

09/12/2025

TransUnion Canada

POLICY AMENDMENT

1. Acknowledging the receipt of an access request in writing within 30 days. I recommended adding explanatory wording within their acknowledgment (e.g., clarifying identification requirements and their process for receiving access requests via mail, as per their policy). This ensures the requester is informed of any missing information needed to fulfill the access request.

2. Informing the requester/complainant of their right to file a complaint with the Office of the Privacy Commissioner of Canada once the access request has been fulfilled or the investigation into a complaint/dispute is completed. This helps the requester/complainant understand that this is the organization’s final response.

09/12/2025

TransUnion Canada

POLICY AMENDMENT

Community Resources

TEMPLATE

Demand Proof of Consent

- Consent Verification

- Proof Request

- Rights Protection

- Accountability Tool

GUIDE

Understand Mandatory Notice Requirements

- Notice Requirements

- Consumer Protection

- Legal Compliance

- Rights Awareness

FRAC – Standing Strong for Your Financial Rights

Support the movement

#THEBOLDRISK

Be BOLD — grab your Statement Tee and join the community

SPREAD THE WORD